Maximizing Your Tax Refund in Germany: Tips and Tricks for Expats

Getting a tax refund in Germany can be a significant financial boost, but it requires knowing how to navigate the system effectively. By understanding the deductions and credits available to you, particularly as an expat, you can maximize your refund. This blog post provides practical tips and tricks for maximizing your tax refund in Germany.

Outline:

- How tax refunds work in Germany

- Common deductions and credits for expats

- Keeping accurate records to maximize your refund

- Filing strategies to optimize your refund

- Role of tax consultants in securing the best refund

How Tax Refunds Work in Germany

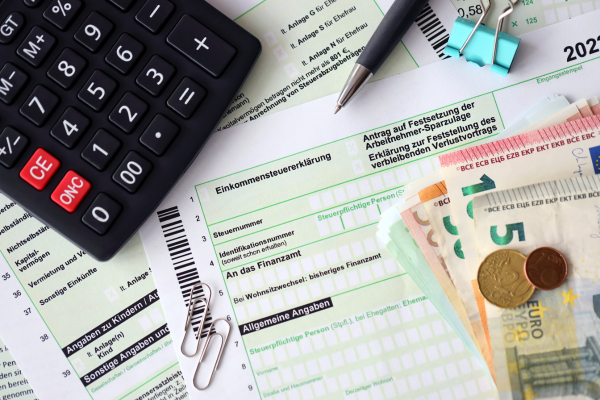

Tax refunds in Germany occur when the taxes withheld from your income exceed your actual tax liability, which is common if you qualify for various deductions and credits. The tax office (Finanzamt) reviews your annual tax return to determine if you’ve overpaid. If so, you’ll receive a refund, which averages over €1,000 for many employees. Understanding how tax refunds work in Germany is crucial for ensuring you receive what you’re entitled to. Utilizing tax deductions effectively can significantly boost your refund, making it worthwhile to file your tax return even if it’s not mandatory.

Common Deductions and Credits for Expats

Expats in Germany can benefit from various tax deductions and credits that help reduce their overall tax burden. Common deductions include work-related expenses like commuting, home office costs, and professional training. Additionally, expats can deduct relocation expenses, especially when moving for work, and claim the child allowance (Kinderfreibetrag) if they have children. Understanding these common deductions and credits for expats in Germany is essential for maximizing your tax refund and minimizing your taxable income.

Keeping Accurate Records to Maximize Your Refund

Keeping accurate records is crucial to maximizing your tax refund in Germany. This involves maintaining detailed receipts, invoices, and documentation for all deductible expenses throughout the year, such as work-related costs, donations, and education expenses. Proper record-keeping ensures that when you file your tax return, you can substantiate your claims and potentially increase your refund. Leveraging tools like tax software or consulting a tax advisor can also help you stay organized and ensure no deductions are overlooked.

Filing Strategies to Optimize Your Refund

To get the largest tax refund possible in Germany, it’s important to use smart filing strategies. Filing your tax return voluntarily, even when not required, often results in a refund. Additionally, choosing the correct tax class in Germany and understanding how life events like marriage or having children affect your tax liability can lead to significant savings. Using tax software or consulting a tax expert can help identify deductions you might otherwise miss, optimizing your refund.

Role of Tax Consultants in Securing the Best Refund

Tax consultants (Steuerberater) play a crucial role in helping individuals secure the maximum possible tax refund in Germany. These professionals are well-versed in the complexities of the German tax system and can assist in identifying all eligible deductions and credits. For expats, tax consultants provide tailored advice on international tax issues, ensuring compliance with both German and foreign regulations. While there is a cost associated with hiring a tax consultant, their expertise often results in a larger refund that justifies the expense.

Disclaimer:

The information provided in this blog post is for general informational purposes only and does not constitute tax, legal, or financial advice. While we strive to ensure the accuracy and timeliness of the information, tax laws are complex and subject to change. We recommend consulting with a certified tax advisor for advice tailored to your individual circumstances. In terms of financial consultation, we collaborate with German Sherpa Financial Solutions, specializing in services for Expats in Germany. Please note that this content does not serve as tax consulting.

Exploring Tax Deductions: How to Lower Your Taxable Income in Germany

Exploring Tax Deductions: How to Lower Your Taxable Income in Germany Tax deductions are one…

The Best Tax-Saving Strategies for Families in Germany

The Best Tax-Saving Strategies for Families in Germany Families in Germany can take advantage of…

What Can You Deduct? A Comprehensive List of Tax-Deductible Expenses in Germany

What Can You Deduct? A Comprehensive List of Tax-Deductible Expenses in Germany Knowing what expenses…

Understanding Tax-Free Allowances and Flat Rates in Germany

Understanding Tax-Free Allowances and Flat Rates in Germany Tax-free allowances and flat rates are essential…

Claiming Work-Related Expenses: How to Reduce Your Tax Bill in Germ

Claiming Work-Related Expenses: How to Reduce Your Tax Bill in Germany Work-related expenses are some…

Donations, Insurance, and More: How to Maximize Your Tax Deductions in Germany

Donations, Insurance, and More: How to Maximize Your Tax Deductions in Germany In Germany, certain…

The Complete Guide to Deductible Medical Expenses on Your German Tax Return

The Complete Guide to Deductible Medical Expenses on Your German Tax Return Medical expenses can…

How to Deduct Education and Training Expenses on Your German Tax Return

How to Deduct Education and Training Expenses on Your German Tax Return Investing in education…

Home Office Deduction in Germany: How to Claim It and Maximize Your Savings

Home Office Deduction in Germany: How to Claim It and Maximize Your Savings With the…

Tax Classes in Germany (Steuerklassen): What You Need to Know

Tax Classes in Germany (Steuerklassen): What You Need to Know Germany’s tax system uses tax…

Tax-Free Savings in Germany: Making the Most of Your Allowances

Tax-Free Savings in Germany: Making the Most of Your Allowances Tax-free savings allowances in Germany…

Income Thresholds, Tax-Free Amounts, and Tax Brackets

Income Thresholds, Tax-Free Amounts and Tax Brackets Germany uses a progressive income tax system, which…

Claiming Moving Expenses on Your German Tax Return: What You Need to Know

Claiming Moving Expenses on Your German Tax Return: What You Need to Know Moving for…

How and When to Change Your Tax Class

How and When to Change Your Tax Class Changing your tax class can have a…

How to Deduct Childcare Expenses on Your German Tax Return

How to Deduct Childcare Expenses on Your German Tax Return Raising a child in Germany…

Filing Your Taxes in Germany: Your Options

Filing Your Taxes in Germany: Your Options In Germany, tax returns (Steuererklärungen) are usually due…

Who Can Legally Help You File Your Taxes?

Who Can Legally Help You File Your Taxes? In Germany, only certain professionals are authorized…

Top Strategies to Legally Reduce Your Taxes in Germany

Top Strategies to Legally Reduce Your Taxes in Germany Paying taxes is a part of…

How to Optimize Your Tax Class to Save Money in Germany

How to Optimize Your Tax Class to Save Money in Germany Choosing the right tax…