How to Deduct Education and Training Expenses on Your German Tax Return

Investing in education and professional training can be costly, but the good news is that many of these expenses are tax-deductible in Germany. Whether you’re pursuing further education or attending training courses to enhance your career, this blog post will guide you through the process of deducting education and training expenses on your German tax return.

Outline:

- Overview of tax-deductible education and training expenses.

- How to claim deductions for university tuition, vocational training and professional development courses.

- The difference between initial education and continuing education for tax purposes.

- Required documentation and how to file for these deductions.

- Examples of deductible expenses (books, tuition, travel).

Overview of Tax-Deductible Education and Training Expenses

In Germany, education and training expenses can be deducted from your taxable income if they are directly related to your current or future employment. These tax-deductible expenses include costs for university tuition, vocational training, and professional development courses. The key is that the education or training must be aimed at improving or maintaining your professional skills or qualifications. Whether you’re investing in further education to advance your career or attending a course to stay updated in your field, understanding which expenses qualify as deductible can help you reduce your taxable income and potentially receive a significant tax refund.

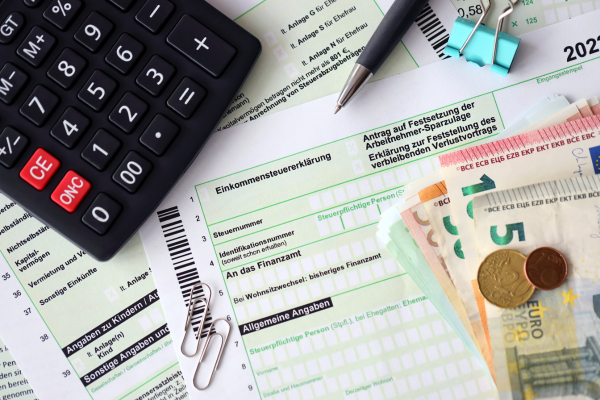

How to Claim Deductions for University Tuition, Vocational Training and Professional Development Courses

Claiming deductions for education-related expenses in Germany requires that the costs are clearly related to your employment. University tuition fees, vocational training, and professional development courses can all be claimed as deductions, provided they enhance your professional qualifications or are necessary for your job. When filing your tax return, these expenses are listed under “Werbungskosten” (work-related expenses) or “Sonderausgaben” (special expenses) depending on the nature of the education. You’ll need to provide detailed records and receipts for the costs you’re claiming, including course fees, travel expenses, and any required materials.

The Difference Between Initial Education and Continuing Education for Tax Purposes

In the context of tax deductions in Germany, there is a significant difference between initial education (Erstausbildung) and continuing education (Fortbildung). Initial education, such as your first degree or vocational training, generally falls under “Sonderausgaben” with a maximum deduction limit. However, expenses for continuing education, which includes further degrees, certifications, or any education pursued after starting your career, are fully deductible under “Werbungskosten” as long as they directly relate to your current or future job. Understanding this distinction is crucial, as it determines how much of your education-related expenses you can deduct and where to list them on your tax return.

Required Documentation and How to File for These Deductions

To successfully claim tax deductions for education and training expenses in Germany, meticulous documentation is essential. You’ll need to keep all invoices, receipts, and proof of payment related to tuition fees, course materials, travel expenses, and any other costs associated with your education or training. When filing your tax return, these documents support your claims and ensure they are accepted by the tax authorities. Education-related expenses should be itemized under the appropriate sections, such as “Werbungskosten” for work-related training or “Sonderausgaben” for initial education. Submitting your return through the ELSTER online tax filing system is recommended to streamline the process.

Examples of Deductible Expenses (Books, Tuition, Travel)

There are several examples of education-related expenses that can be deducted from your taxable income in Germany. These include tuition fees for university courses, vocational training programs, and professional development seminars. Additionally, the cost of textbooks, study materials, and required equipment can be deducted. Travel expenses incurred for attending courses, such as public transportation costs or mileage if you drive, are also deductible. Even accommodation costs, if you need to stay overnight for a course, can be included. By identifying and documenting these expenses, you can maximize your deductions and reduce your tax liability.

Disclaimer:

The information provided in this blog post is for general informational purposes only and does not constitute tax, legal, or financial advice. While we strive to ensure the accuracy and timeliness of the information, tax laws are complex and subject to change. We recommend consulting with a certified tax advisor for advice tailored to your individual circumstances. In terms of financial consultation, we collaborate with German Sherpa Financial Solutions, specializing in services for Expats in Germany. Please note that this content does not serve as tax consulting.

How to Optimize Your Tax Class to Save Money in Germany

How to Optimize Your Tax Class to Save Money in Germany Choosing the right tax…

Exploring Tax Deductions: How to Lower Your Taxable Income in Germany

Exploring Tax Deductions: How to Lower Your Taxable Income in Germany Tax deductions are one…

The Best Tax-Saving Strategies for Families in Germany

The Best Tax-Saving Strategies for Families in Germany Families in Germany can take advantage of…

What Can You Deduct? A Comprehensive List of Tax-Deductible Expenses in Germany

What Can You Deduct? A Comprehensive List of Tax-Deductible Expenses in Germany Knowing what expenses…

Understanding Tax-Free Allowances and Flat Rates in Germany

Understanding Tax-Free Allowances and Flat Rates in Germany Tax-free allowances and flat rates are essential…

Claiming Work-Related Expenses: How to Reduce Your Tax Bill in Germ

Claiming Work-Related Expenses: How to Reduce Your Tax Bill in Germany Work-related expenses are some…

Donations, Insurance, and More: How to Maximize Your Tax Deductions in Germany

Donations, Insurance, and More: How to Maximize Your Tax Deductions in Germany In Germany, certain…

The Complete Guide to Deductible Medical Expenses on Your German Tax Return

The Complete Guide to Deductible Medical Expenses on Your German Tax Return Medical expenses can…

Home Office Deduction in Germany: How to Claim It and Maximize Your Savings

Home Office Deduction in Germany: How to Claim It and Maximize Your Savings With the…

Tax Classes in Germany (Steuerklassen): What You Need to Know

Tax Classes in Germany (Steuerklassen): What You Need to Know Germany’s tax system uses tax…

Tax-Free Savings in Germany: Making the Most of Your Allowances

Tax-Free Savings in Germany: Making the Most of Your Allowances Tax-free savings allowances in Germany…

Income Thresholds, Tax-Free Amounts, and Tax Brackets

Income Thresholds, Tax-Free Amounts and Tax Brackets Germany uses a progressive income tax system, which…

Claiming Moving Expenses on Your German Tax Return: What You Need to Know

Claiming Moving Expenses on Your German Tax Return: What You Need to Know Moving for…

How and When to Change Your Tax Class

How and When to Change Your Tax Class Changing your tax class can have a…

How to Deduct Childcare Expenses on Your German Tax Return

How to Deduct Childcare Expenses on Your German Tax Return Raising a child in Germany…

Filing Your Taxes in Germany: Your Options

Filing Your Taxes in Germany: Your Options In Germany, tax returns (Steuererklärungen) are usually due…

Who Can Legally Help You File Your Taxes?

Who Can Legally Help You File Your Taxes? In Germany, only certain professionals are authorized…

Top Strategies to Legally Reduce Your Taxes in Germany

Top Strategies to Legally Reduce Your Taxes in Germany Paying taxes is a part of…

Maximizing Your Tax Refund in Germany: Tips and Tricks for Expats

Maximizing Your Tax Refund in Germany: Tips and Tricks for Expats Getting a tax refund…